tax identity theft occur

In 2020 the most common types of identity theft were government document or benefit fraud credit card fraud specifically opening new accounts and loan or lease fraud. You may pay a fee to order your credit report online if you want to see it right away.

What Is Tax Identity Theft And How Do You Prevent It Debt Com

Security Data Breach Information.

. What you can do. Whether youre a victim or trying to protect your ID Equifax can help you better understand and protect from ID theft. Learn more about identity theft.

Ghosting is a form of identity theft in which someone steals the identity and sometimes even the role within society of a specific dead person the ghost whose death is not widely known. While the FBI hasnt collected specific data on home title theft the crime falls under identity theft the FTC reports this as the largest threat consumers face. You must receive your credit report by mail.

In addition to reporting identity theft to the FTC you should contact your local law enforcement and file a police report. Other Identity Theft Statistics The Most Common Types of Identity Theft. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis.

Be alert for phone calls texts and emails claiming to be from the Internal Revenue Service IRS. Usually the person who steals this identity the ghoster is roughly the same age that the ghost would have been if still alive so that any documents citing the birthdate of the ghost will not be. 1799 or 2399 a month Coming in at No.

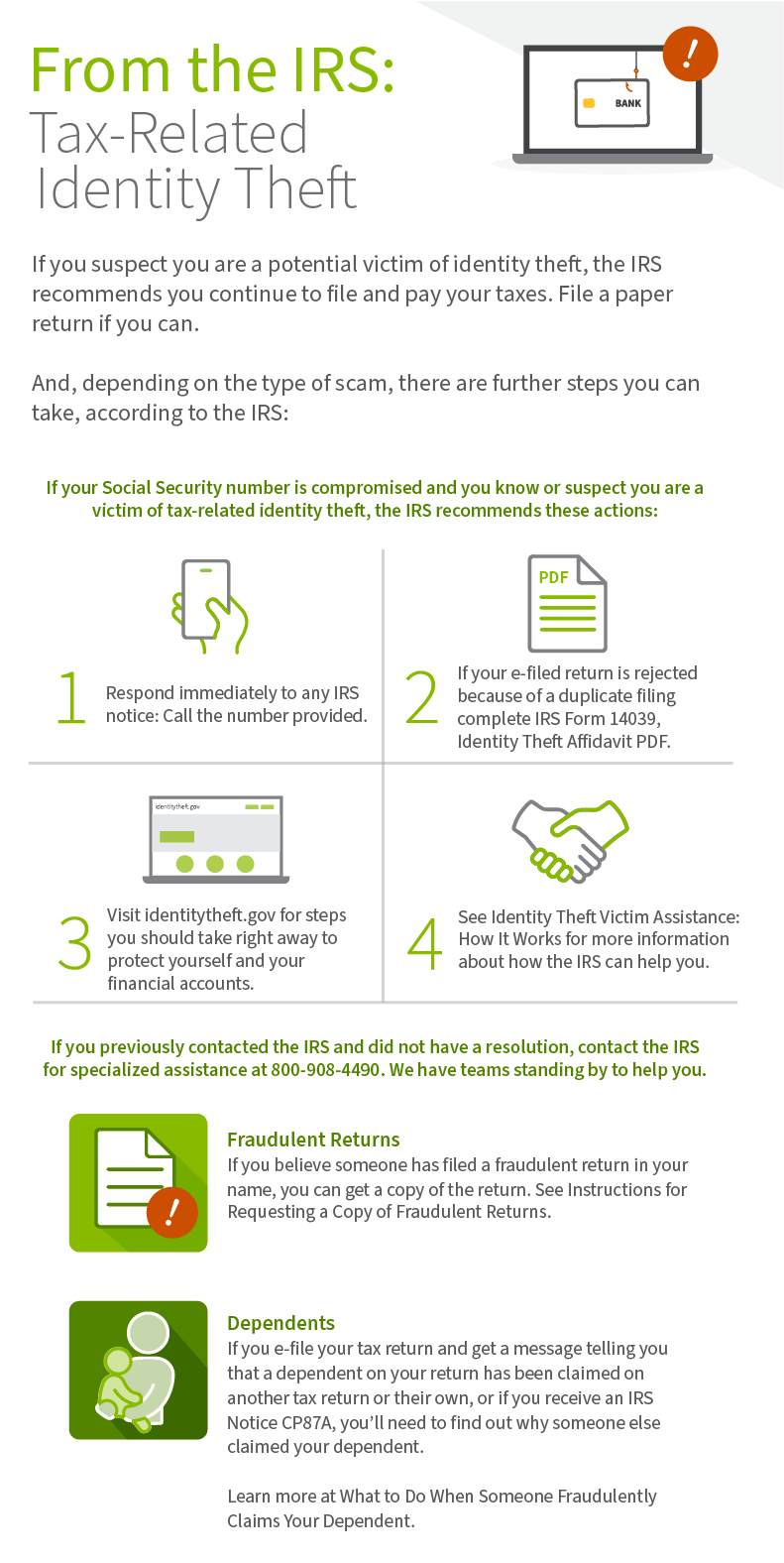

For federal tax identity theft please visit the IRS. Watch out for tax scams. If you are covered by identity theft insurance a police report may be required in order to submit an insurance claim.

45 Fraud Prevention Tips. If taxpayers are uncertain about the validity of a notice received from the IRS they can visit Tax Scams How to Report Them for more information. If any of these occur there are many steps you should consider taking.

In 2020 the FTC reports that Americans lost more than 33 billion from different types of financial fraudTo lock fraudsters out you need to update how you safeguard your data and PII personally identifiable information. Certain events that occur during the period of your ownership may increase or decrease your basis resulting in an adjusted basis Increase your basis by items such as the cost of improvements that add to the value of the property and decrease it by items such as allowable depreciation and insurance reimbursements for casualty and theft losses. These occur when a company has gotten your name and address from a credit bureau to send you an offer of credit.

Promotional inquiries are not signs of fraud. You may also need to provide your Social Insurance Number andor a credit card number to confirm your identity. IdentityForce Best Identity Theft Protection Service of 2022 tie.

For more information see. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. Home title theft has become a growing concern in the cybersecurity business with FBI reports and other data supporting that.

Disputed by name of source such as creditors or tax. ID Resolve eliminates the worries and problems of recovering from identity theft and helps you protect your money and your financial reputation with identity theft resolution and restoration services. It lists the actions most identity theft victims should take to limit the damage done by the thief.

According to the Journal of World Economic Research deed theft amounted to 547 million in 2020. Notifications that more than one tax return was filed in your name or unexpected denial of credit. The IRS will not contact consumers using these methods and wont threaten.

Consider freezing or locking your credit. YouTube videos help explain notices. Sometimes businesses or governmental entities experience data breaches which occur when private information becomes publically available.

This type of identity theft involves ID thieves using your personal information to file a tax return and get a refund your refund. 1 in our rating IdentityForces comprehensive identity theft protection plans. Cybercriminals make it their job to find new ways to take advantage of unsuspecting victims.

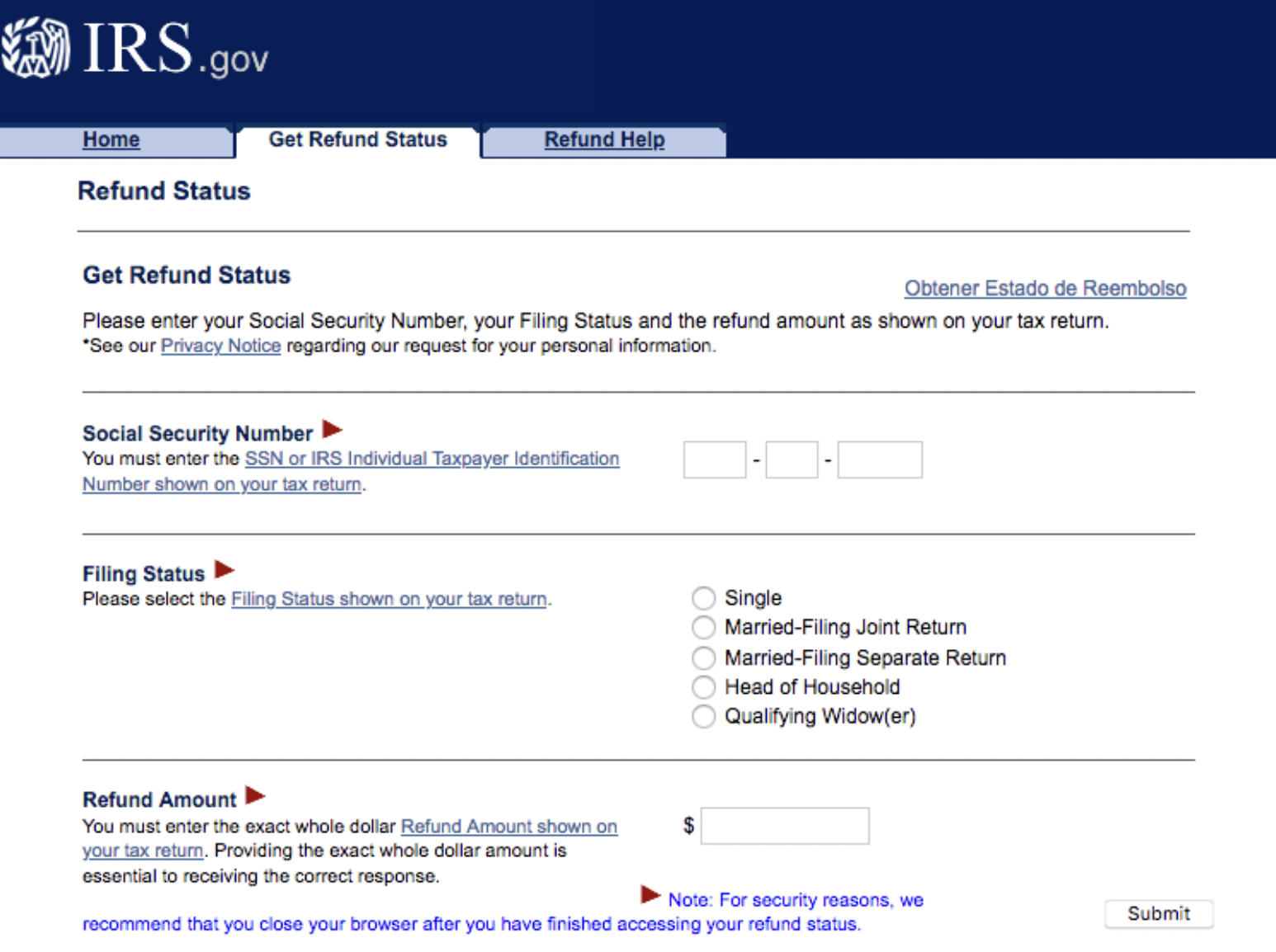

Confirm your identity by answering a series of personal and financial questions. Be on the lookout for tax scams which can occur through email on the phone or through the mail. For state tax identity theft please visit the State of Ohio Department of Taxation.

Anyone with a Social Security number can be the subject of identity theft but according to the FTCs 2021 Sentinel Data Book published in February 2022 the most targeted victims. Complete identity theft recovery averages 40 hours and can easily take more than 6 months and 100 hours of work. The pandemic gave identity thieves a perfect storm in which to operate.

What Is Tax Related Identity Theft And How Can You Recover From It

The How And Why Of Tax Identity Theft Itrc

Benefits Of Mixed Use Development Infographicbee Com Mixed Use Development Development Data Visualization

Tax Identity Theft What To Do If You Ve Been Targeted Jackson Hewitt

How Common Is Tax Identity Theft Experian

Will Identity Theft Delay My Tax Refund Experian

8 Signs Of Identity Theft Doing More Today

The Irs Says Criminals Have To Report Illegal Income Seriously Upworthy

What Is Identity Theft Identity Fraud Vs Identity Theft Fortinet

What Happens After You Report Tax Identity Theft To The Irs H R Block

Tax Identity Theft American Family Insurance

Someone Stole My Tax Refund Check What Should I Do

8 Signs Of Identity Theft Doing More Today

Forex Computer Software Ebay Computers Tablets Networking Computer Software Software Personal Finance

It S Tax Season Fighting Tax Identity Theft Is A Team Effort The Irs Has Successfully Partnered With State Tax Agenci Legalshield Team Effort Tax Preparation

When Are Taxes Due In 2022 Forbes Advisor

Deductions For Freelance Event Planner Infographicbee Com In 2022 Tax Deductions Deduction Online Taxes