mississippi income tax rate 2021

You may file your Form 80-105 with paper. Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with MS tax rates of 0 3 4 and 5 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

The 3 percent bracket will be completely eliminated by the start of 2022 but the 4 and 5 percent brackets remain in place.

. Mississippis Individual Income Tax Rate Schedule Tax Year 2021 All Filers 3 4000 4 5000. 2021 Mississippi State Sales Tax Rates The list below details the localities in Mississippi with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. If youre married filing taxes jointly theres a.

The most significant are its income and sales taxes. Tax Rates Exemptions Deductions. Title 27 Chapter 8 Mississippi Code Annotated 27-8-1 Corporate Franchise Tax Laws.

Additionally the 4 percent bracket includes 5000 of taxable income meaning potential savings would amount to a maximum of 200 per year for single and joint filers. In tax year 2021 only 1000 in marginal income will be subject to the 3 percent rate with the other 1000 exempt. Mississippi has a graduated income tax rate and is computed as follows.

For more information about the income tax in these states visit the Louisiana and Mississippi income tax pages. Your average tax rate is. Mississippi Salary Tax Calculator for the Tax Year 202122.

Our calculator has been specially developed. Mississippis 3 Percent Income Tax Rate Will Phase Out by 2022. Mississippis maximum marginal corporate income tax rate is the 3rd lowest in the United States ranking directly below North Dakotas 5200.

3 on the next 2000 of taxable income. Mississippi Income Tax Calculator 2021 If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. However the statewide sales tax of 7 is slightly above the national average.

Income Tax Laws Title 27 Chapter 7 Mississippi Code Annotated 27-7-1. Title 27 Chapter 7 Mississippi Code Annotated 27-7-1 S Corporation Income Tax Laws. Tax rate used in calculating Mississippi state tax for year 2021.

Mississippi Tax Brackets for Tax Year 2021 As you can see your income in Mississippi is taxed at different rates within the given tax brackets. TAX DAY NOW MAY 17th - There are -348 days left until taxes are due. The Mississippi state government collects several types of taxes.

Mississippi continues phasing out its 3 percent corporate income tax bracket by increasing the exemption by 1000 a year exempting the first 4000 of income in 2021. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Form 80-105 is the general individual income tax form for Mississippi residents.

Starting in 2022 only the 4 percent and 5 percent rates will remain with the first 5000 of income exempt from taxation up from 3000. Form 80-100 - Individual Income Tax Instructions. 4 on the next 5000 of taxable income.

The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. You must file online or through the mail yearly by April 17. Corporate Income Tax Returns 2021.

Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets. 0 on the first 4000 of taxable income and 3 on the next 0100 4 on the next 5000 of taxable income and 5 on all taxable income in. Detailed Mississippi state income tax rates and brackets are available on this page.

For income taxes in all fifty states see the income tax by state. In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. Any income over 10000 would be taxes at the highest rate of 5.

Title 27 Chapter 13 Mississippi Code Annotated 27-13-1. Examples are 120 for 6000 190 for 9500 240 for 12000 If no exemptions are claimed enter 000. 5 on all taxable income over 10000.

The Mississippi tax rate and tax brackets are unchanged from last year. Multiply the result by 2. Use this instructional booklet to aid you with filling out and filing your Form 80-105 tax return.

Start filing your tax return now. The personal income tax which has a top rate of 5 is slightly lower than the national average for state income taxes. Taxable and Deductible Items.

0 on the first 3000 of taxable income. Divide the dollar amount in Item 6 of the state certificate by 100. Single married filing separate.

Mississippi State Single Filer Personal Income Tax Rates and Thresholds in 2022. In Mississippi the 4 percent bracket applies to workers earning approximately 13300already a very large portion of the labor force. Mississippi personal income tax rates.

You are able to use our Mississippi State Tax Calculator to calculate your total tax costs in the tax year 202122.

Mississippi Income Tax Calculator Smartasset

Mapped The Cost Of Health Insurance In Each Us State Healthinsuranceproviderscorner Travel Insurance Healthcare Costs Medical Insurance

How To Start A Business In Mississippi Chamber Of Commerce In 2021 Starting A Business Small Business Development Business

Mississippi Sales Tax Small Business Guide Truic

Mississippi Sales Tax Guide And Calculator 2022 Taxjar

The 10 Happiest States In America States In America Wyoming America

Tax Rates Exemptions Deductions Dor

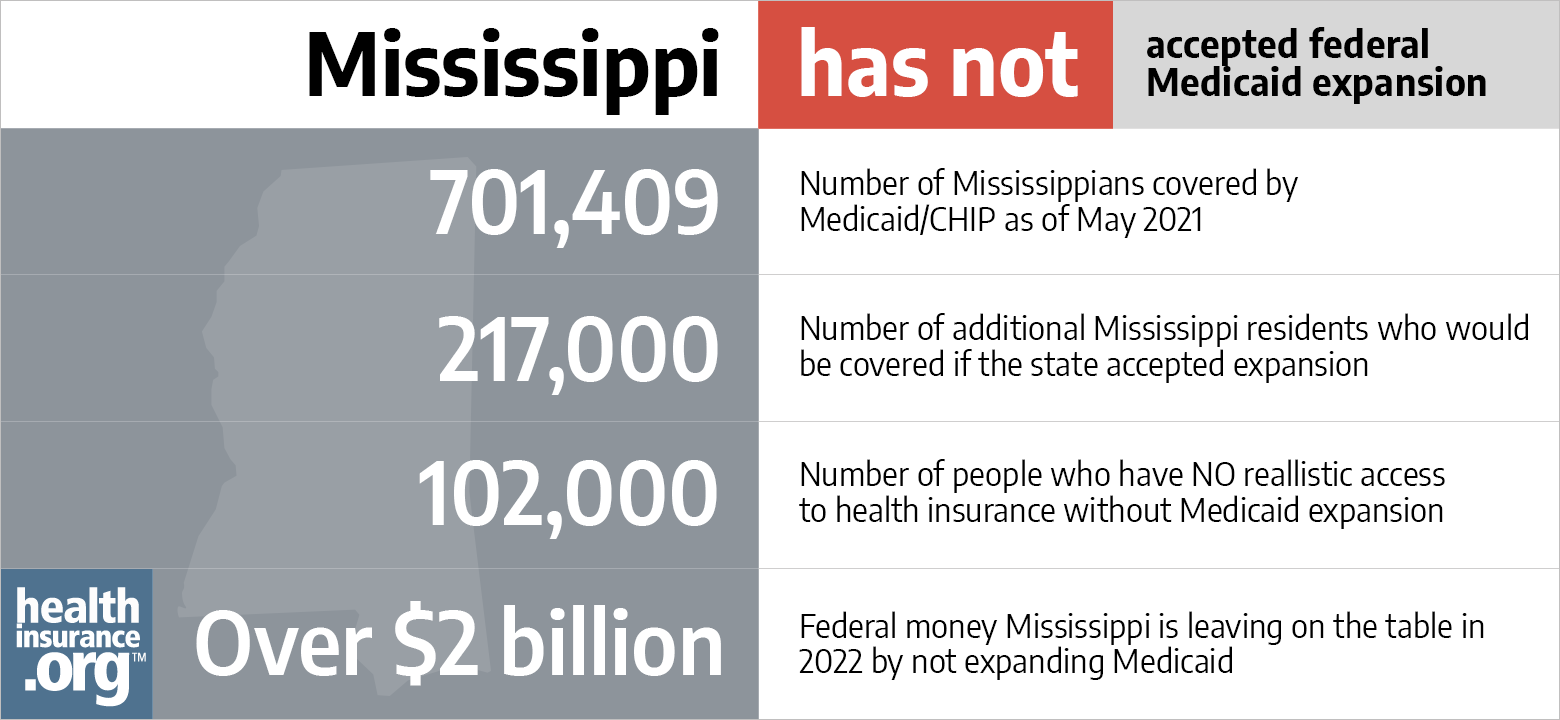

Aca Medicaid Expansion In Mississippi Updated 2022 Guide Healthinsurance Org

Tax Rates Exemptions Deductions Dor

Mississippi Income Tax Brackets 2020

Mississippi Tax Forms And Instructions For 2021 Form 80 105

Mississippi Tax Rate H R Block

Mississippi Income Tax Calculator Smartasset

Historical Mississippi Tax Policy Information Ballotpedia

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Mississippi Tax Rate H R Block

Infographic The Worst Roads In The Usa Infographic Social Science Civil Engineering